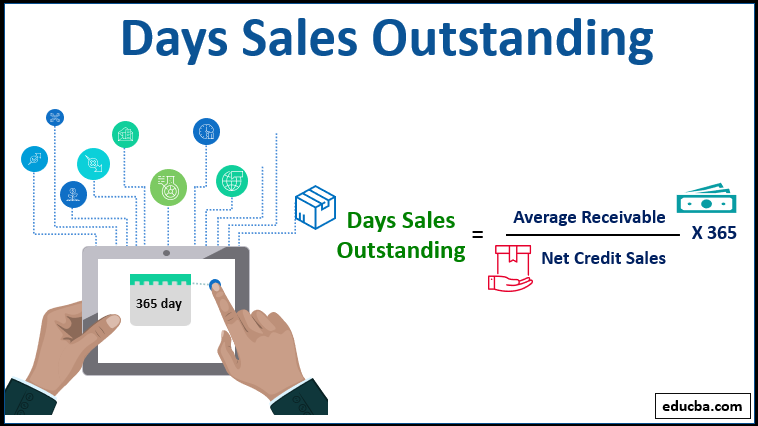

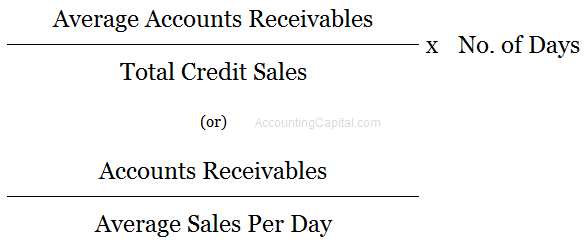

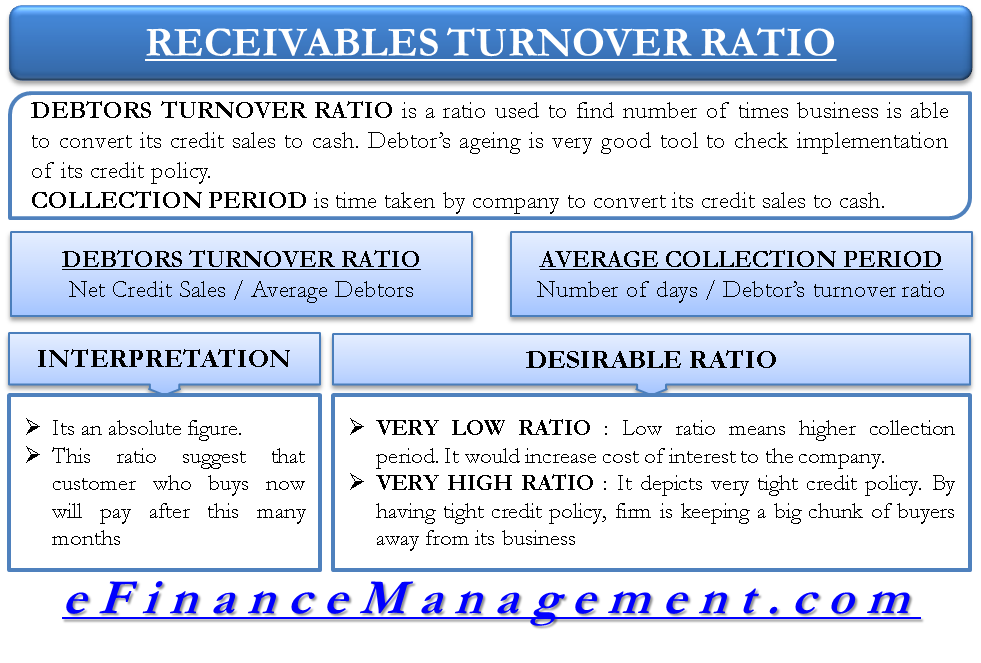

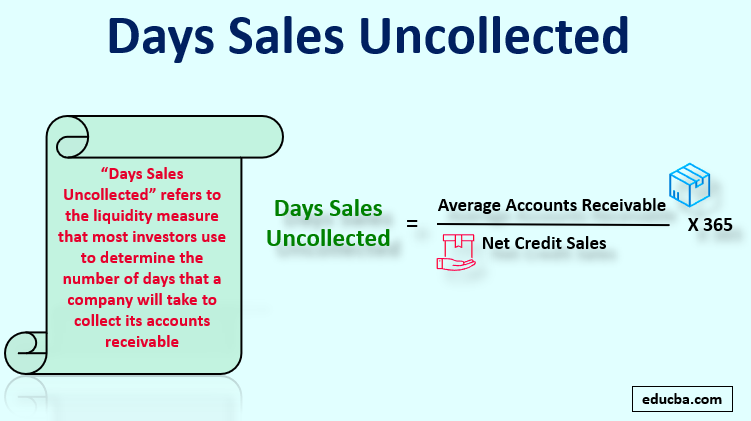

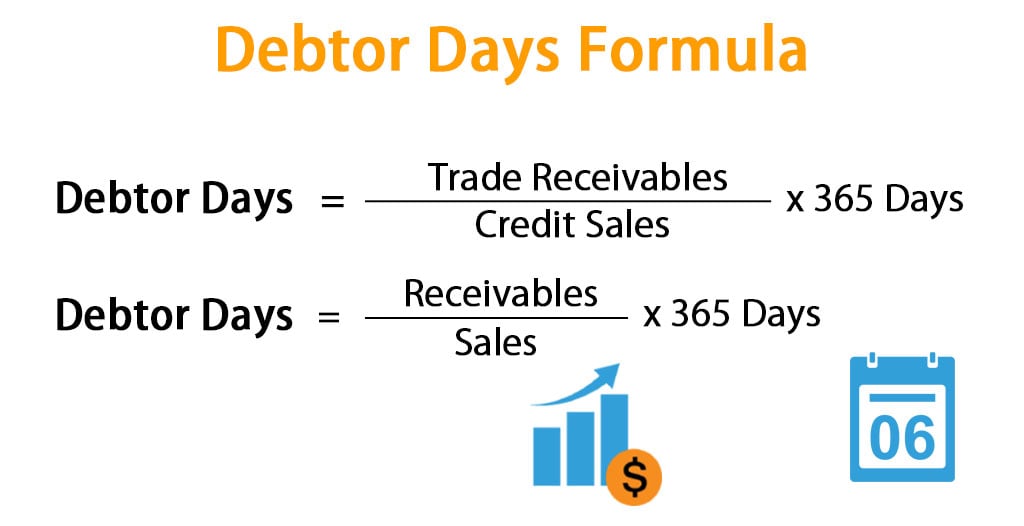

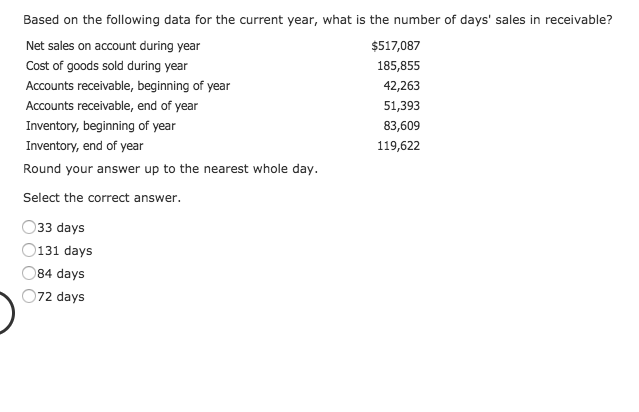

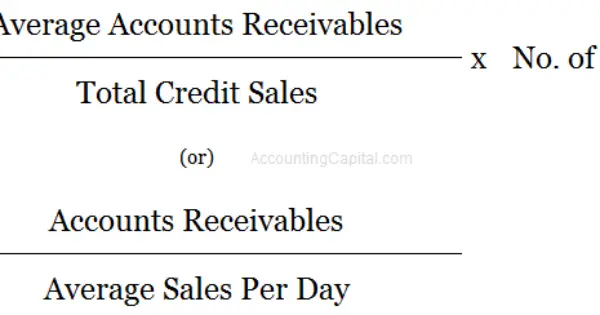

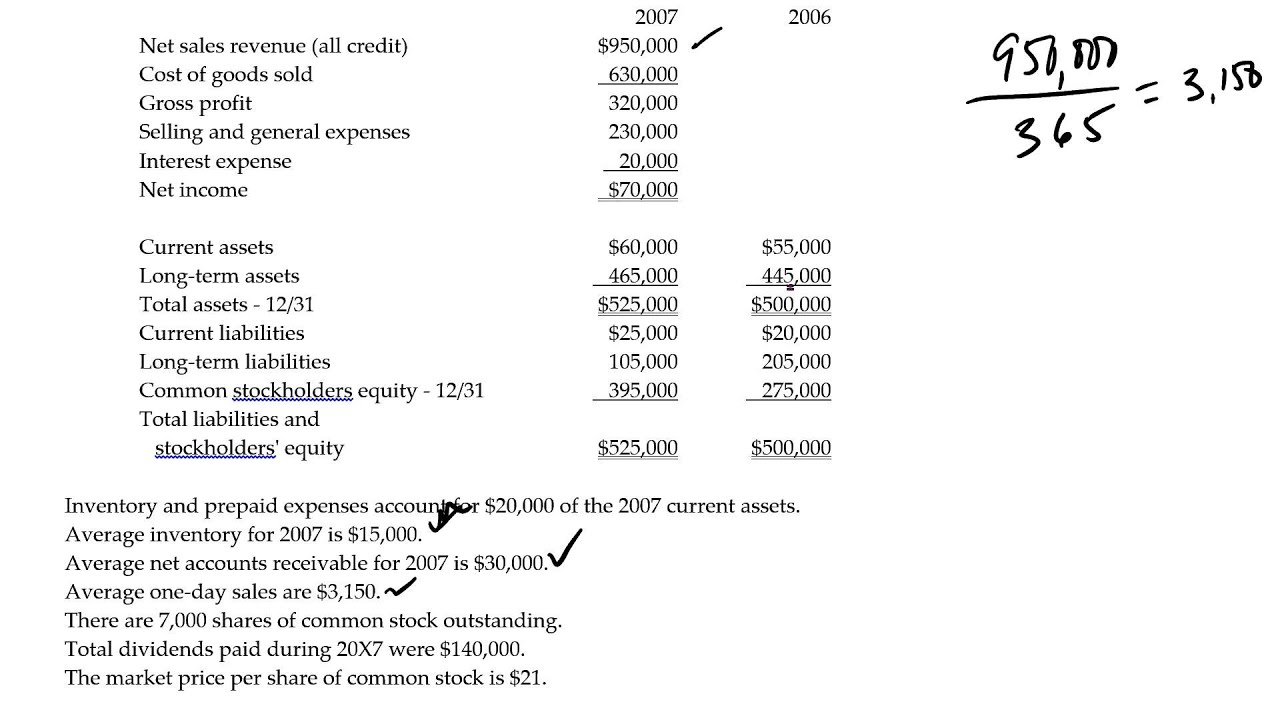

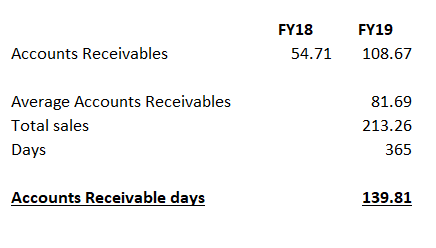

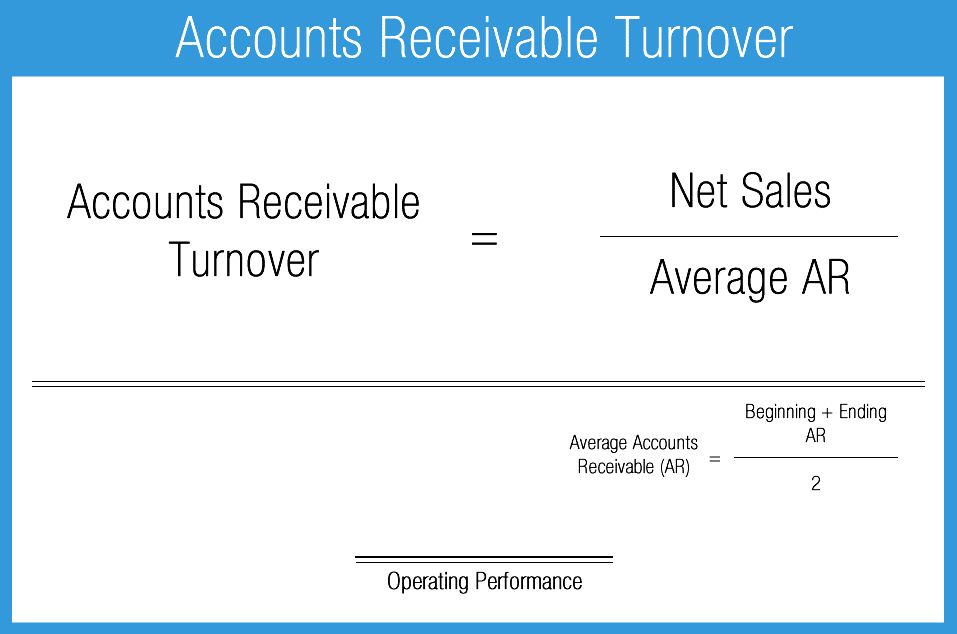

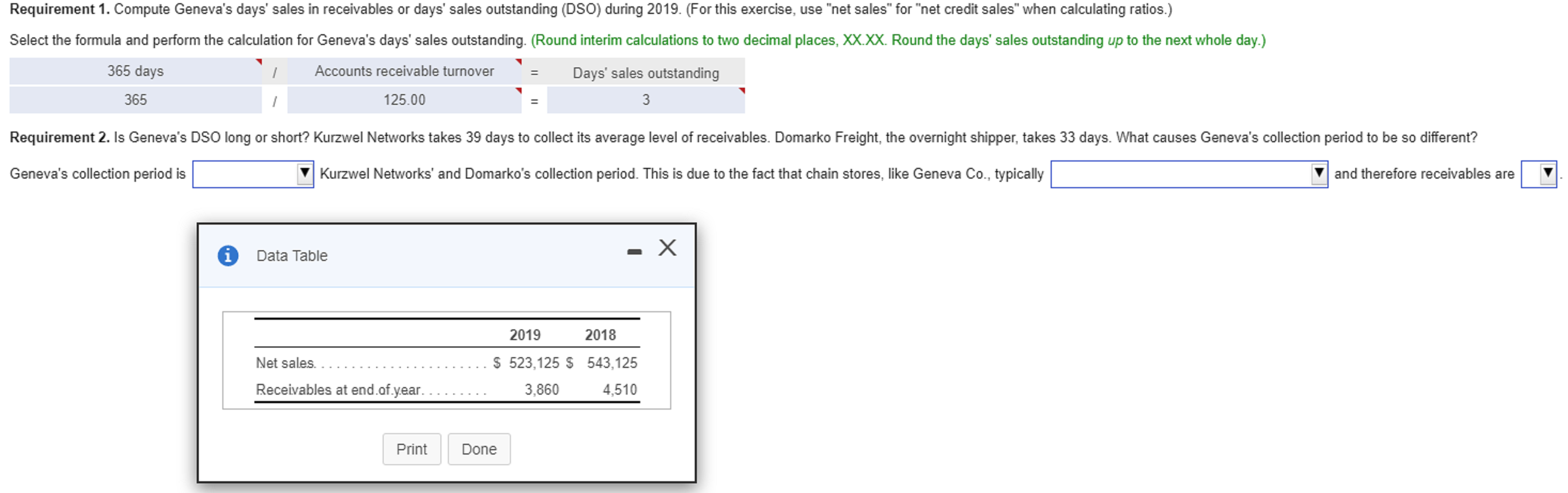

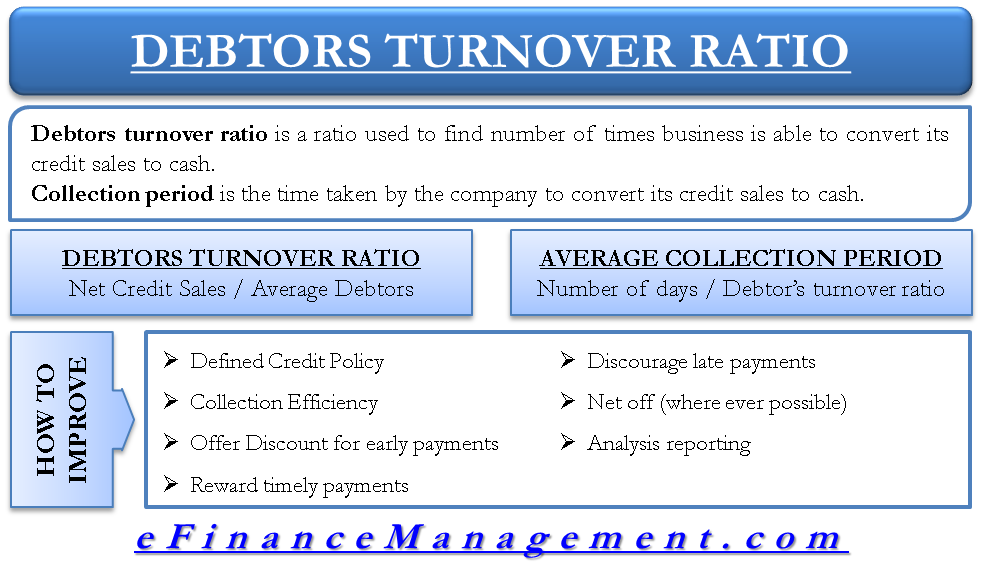

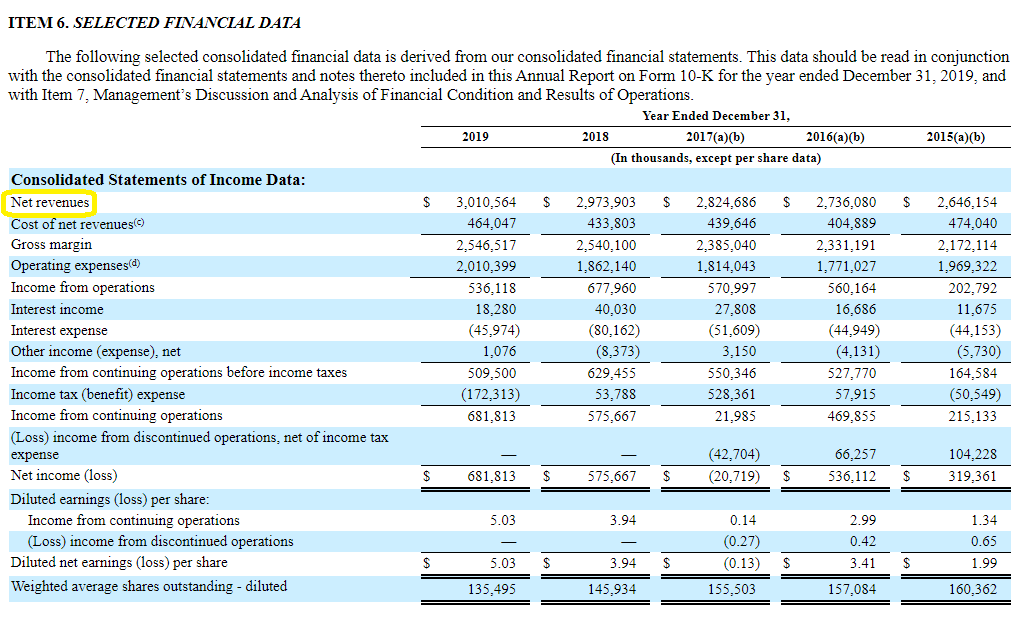

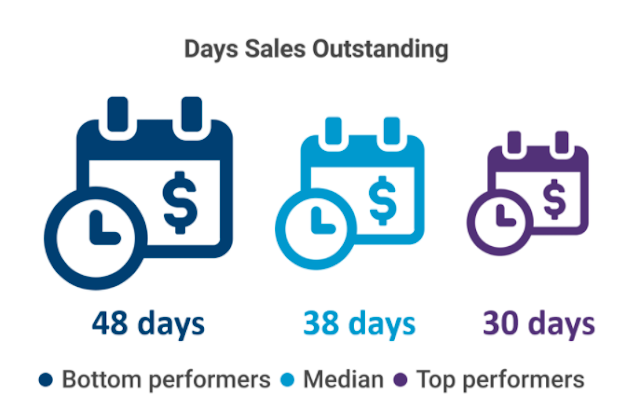

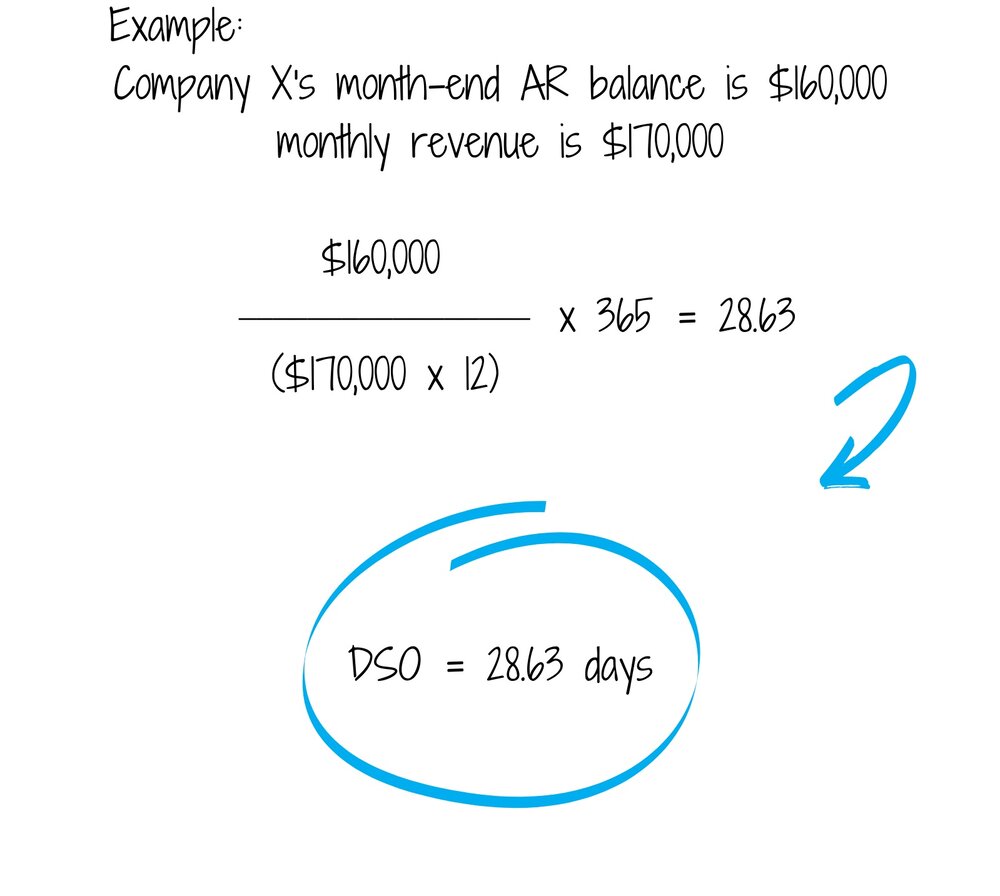

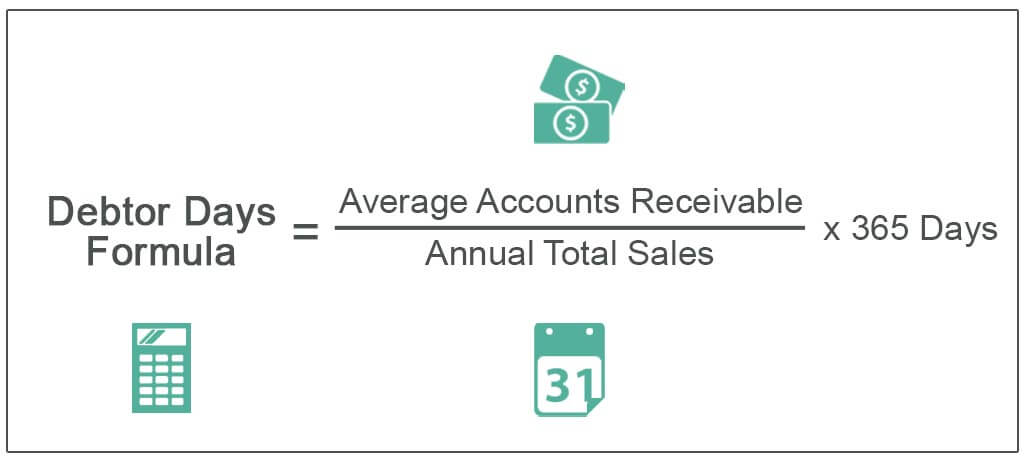

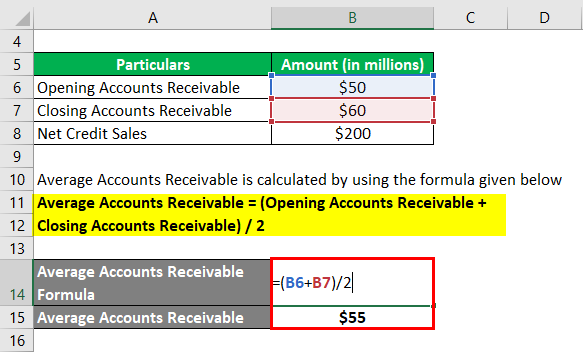

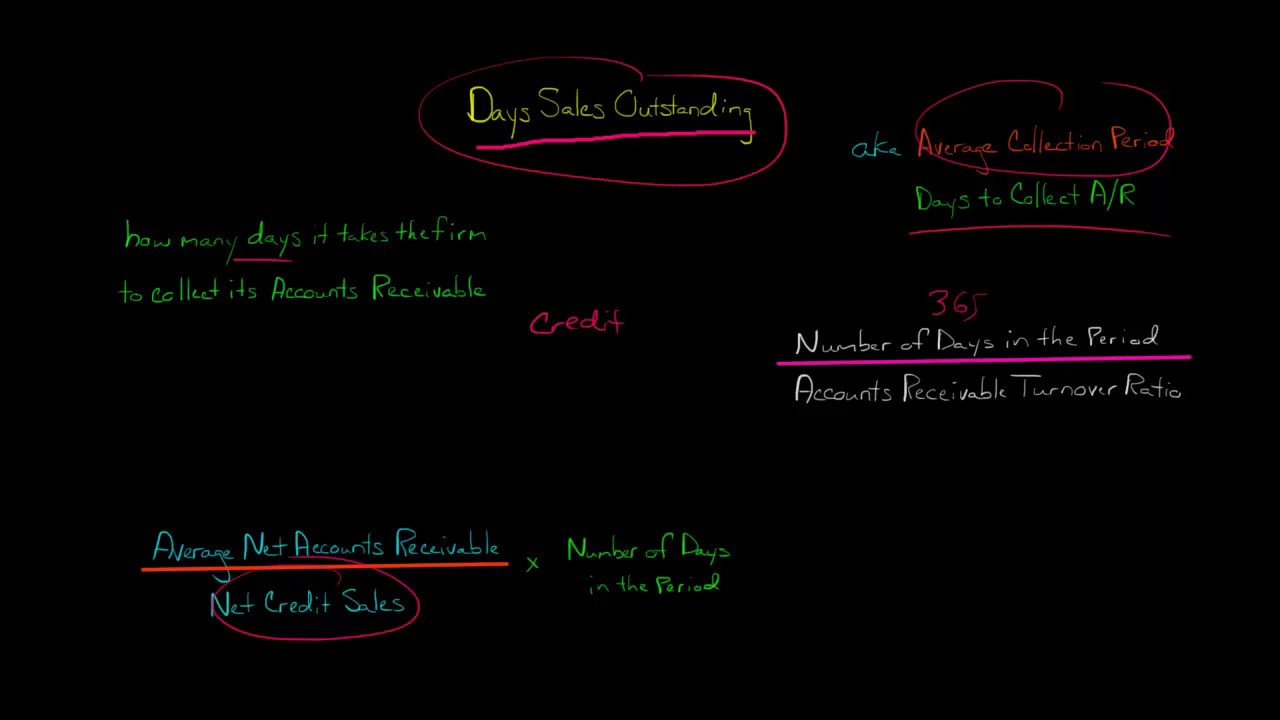

Accounts Receivable Turnover (Days) Accounts Receivable Turnover (Days) (Average Collection Period) – an activity ratio measuring how many days per year averagely needed by a company to collect its receivables In other words, this indicator measures the efficiency of the firm's collaboration with clients, and it shows how long on average the company's clients pay their billsCalculating DSO is a simple equation Divide the Outstanding Balance of A/R by the Total Sales generated during a period of time, and then multiplying the result by the Number of Days of Receivables= (Average Accounts Receivable/Credit Sales) *365 Say for instance, a company A is due to receive Rs 3 lacs out of a credit sales of Rs 10 lacs, then days of receivables would be 3/10*365 which is 1095 days which means it will realize its entire sales in 1095 days

Http Www Gleim Com Public Accounting Updates Cpa Bec 19 Updates Sept 19 Pdf

How to find number of days sales in receivables

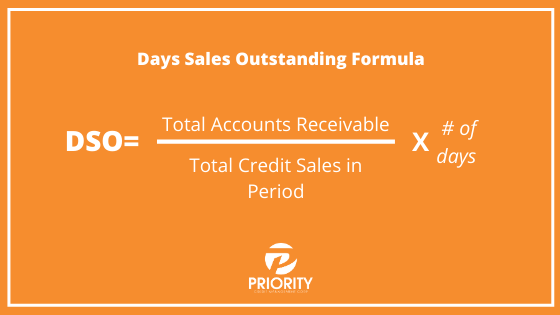

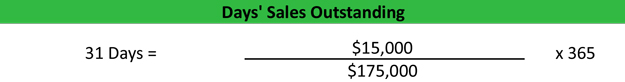

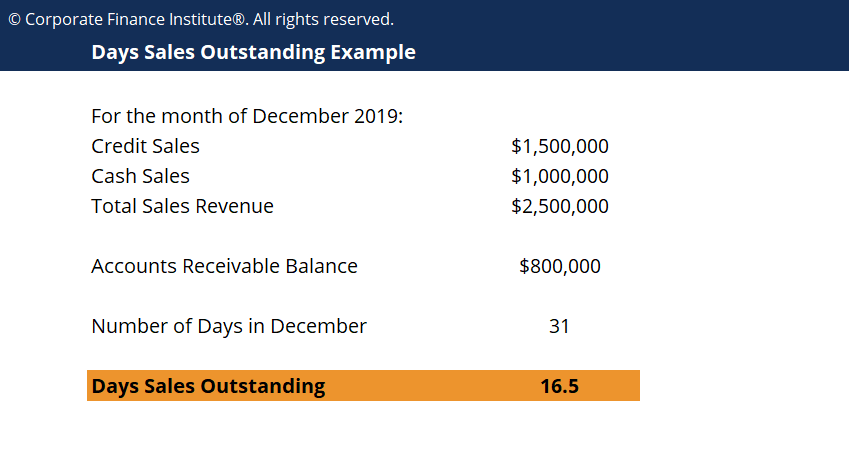

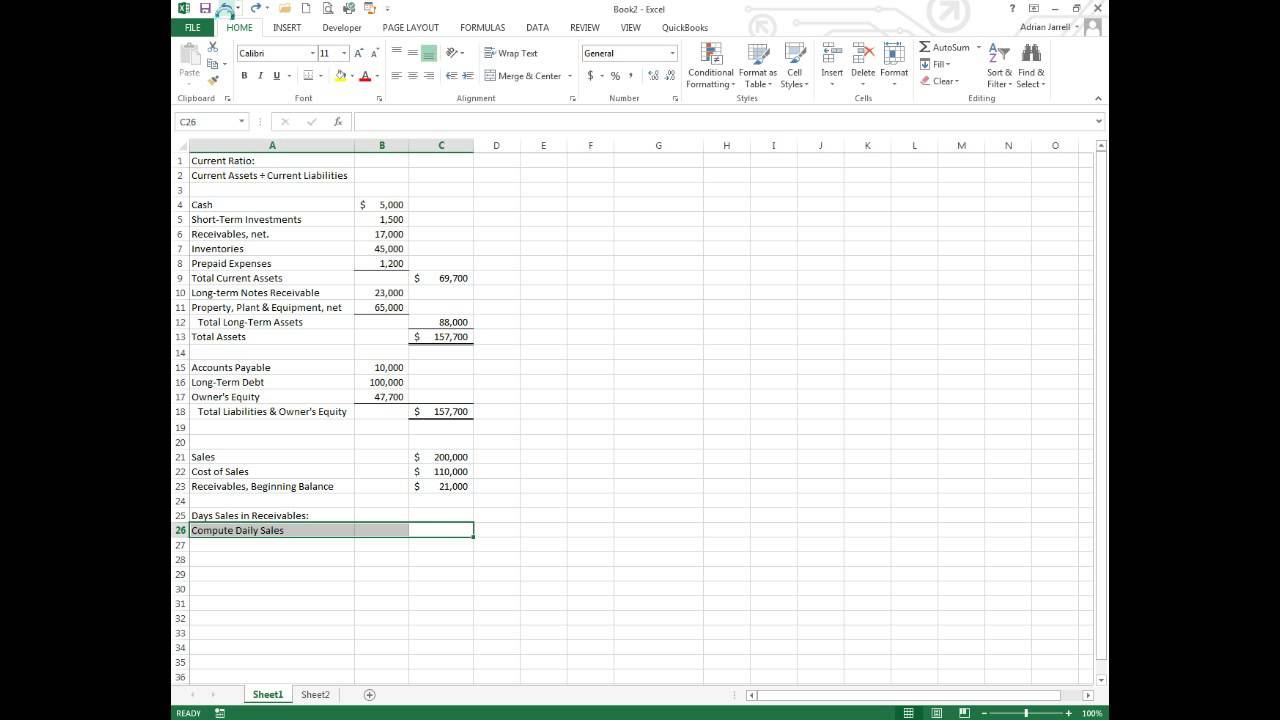

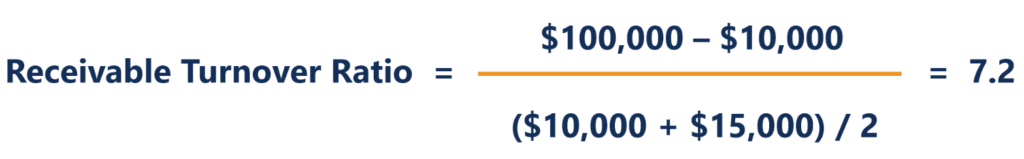

How to find number of days sales in receivables- The formula for accounts receivable days is (Accounts receivable ÷ Annual revenue) x Number of days in the year = Accounts receivable days An effective way to use the accounts receivable days measurement is to track it on a trend line, month by month Doing so shows any changes in the ability of the company to collect from its customersCredit Sales made in a 30 days period = $10,000 Regular DSO = (Total Accounts Receivables/Total Credit Sales) x Number of Days in the period that is being analyzed Regular DSO = (15,000/10,000) x 30 Regular DSO = 45 Days Interpretation On an average it is taking 45 days to convert accounts receivable into Cash

Day Sales Outstanding Formula Calculator Scalefactor

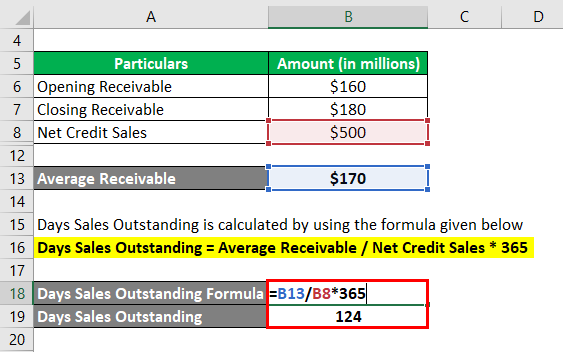

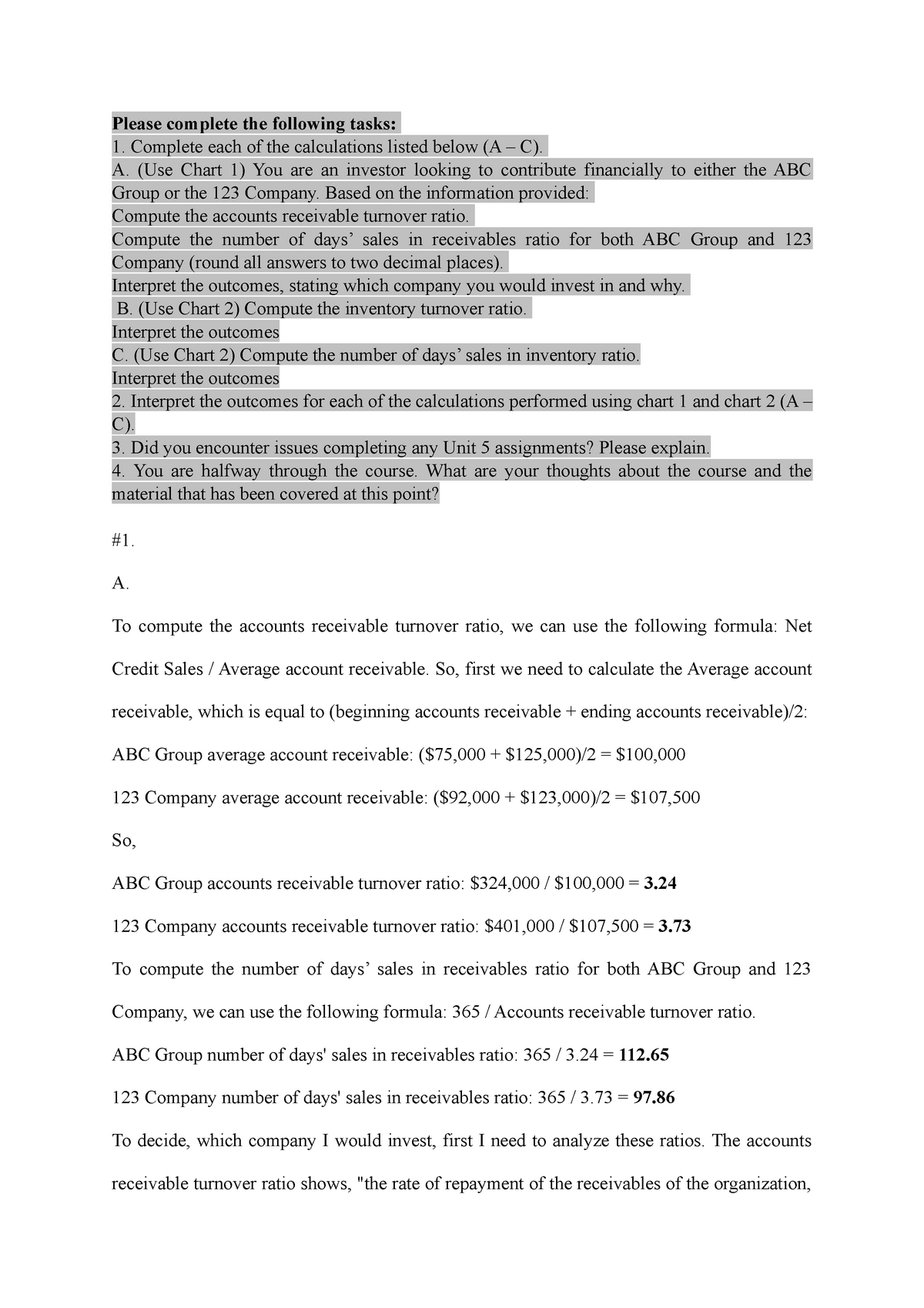

The days sales outstanding formula is September has 30 days in it, so we'll use 30 for your Number of Days This DSO calculation tells us that it takes this example business 15 days (on average, for this time period) to collect on a credit sale, which isDSO Formula = Accounts Receivables / Net Credit Sales * 365 Or, Days Sales Outstanding = $90,000 / $450,000 * 365 = 1/5 * 365 = 73 days That means Company Xing takes 73 days to collect money from its debtors on an average Example#2 Formula Used to Calculate DSO The DSO ratio is calculated by dividing the ending accounts receivable by the total credit sales for the period and multiplying it by the number of days in the period Frequently this DSO is calculated at the end of the year and multiplied by 365 days

Here is the days sales outstanding formula (Accounts Receivable/ Total Sales) x Number of Days = DSO For example, if you wanted to calculate the annual DSO for a business with $225M in it's A/R balance sheet and $150M in total sales, the formula would look like this ($22,500,000 / $150,000,000) x 365 = 5475 days Day sales in accounts receivables is a measure of the average number of days it takes a business to collect payments following a sale The days sales—also called days sales outstanding (DSO)—is a metric that can be calculated on a monthly, quarterly or yearly basis The DSO can be calculated with the following formula DSO = (accounts receivable) / (total credit sales) x Days sales outstanding is often misinterpreted as "the average number of days to fully collect payment after making a sale" The formula for this would be Σ(Sales Date Paid Date) / (Sale Count) This calculation is sometimes called "True DSO" Instead, days sales outstanding is better interpreted as the "days worth of (average) sales

The formula for daily sales oustanding is DSO = Receivables / (Net Annual Sales on Credit / 360) If a company does not sell on credit (that is, the customer must pay immediately), then total sales is used in the denominator For example, let's assume Company XYZ is a department store If, in 10, it made $10,000 of its $15,000 in sales on Average daily sales = Sales / 360 days Number of days sales in accounts receivable = Beginning accounts receivable / average daily sales Estimated ending accounts receivable = estimated sales for the month / 30 days * number of days sales in accounts receivable Days of Sales Outstanding, also known as Days of Receivables, is an estimate of collection period It illustrates how long it takes a company to collect accounts receivables in relation to their level of sales

1

What Is Dso Why Dso Is Vital For Accounts Receivable Billtrust

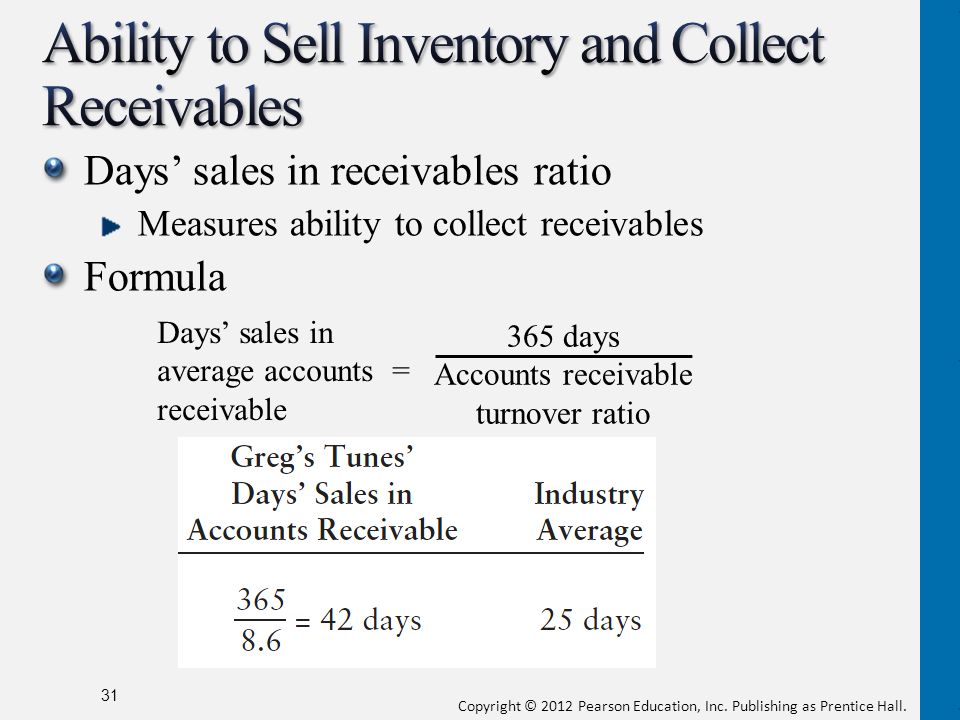

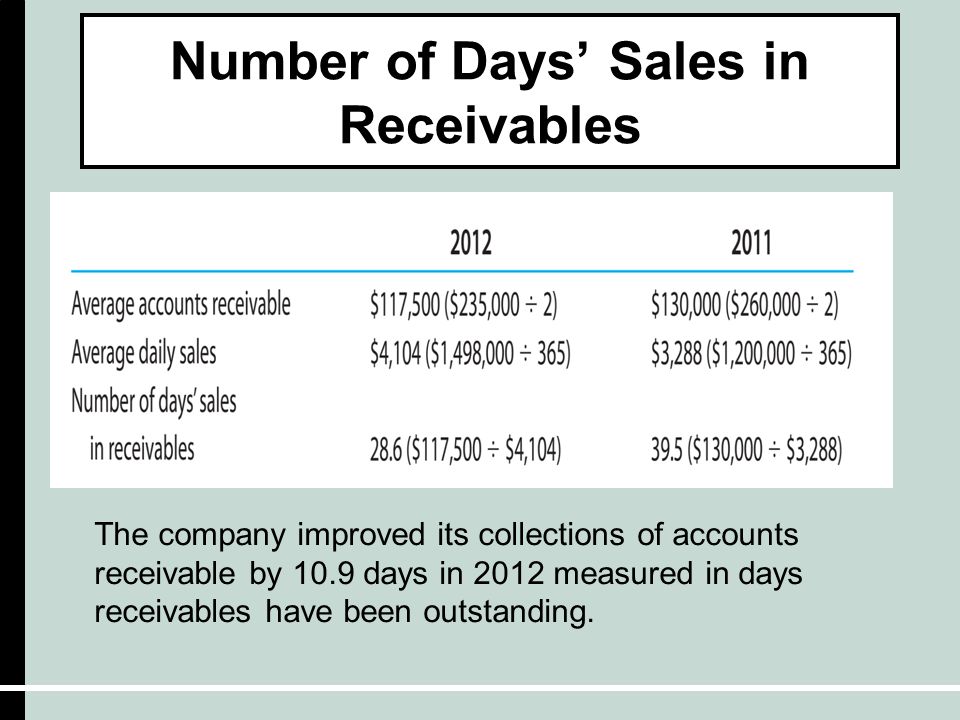

Then, you can use the accounts receivable days formula to work out your total as follows Accounts Receivable Days = (1,000 / 800,000) x 365 = 5475 This tells us that Company A takes just under 55 days to collect a typical invoice If we assume that the payment terms outlined in Company A's invoice were net 30, a significant amount of Receivable days represent the number of days customers are taking to pay a company for its sales We calculate receivable days using the following formula = 365 / (Sales / average of trade receivables outstanding at the start of the year and at the end of the year) Effectively, receivable days represent the number of days (credit period) that Days sales outstanding is closely related to accounts receivable turnover, as DSO can also be expressed as the number of days in a period divided by the accounts receivable turnover The lower the DSO , the shorter the time it takes for a company to collect

How To Reduce Calculate Dso Pcm Corp Priority Credit Management Corp

Receivables Turnover Vs Days Sales Outstanding Dso What S The Difference Gaviti

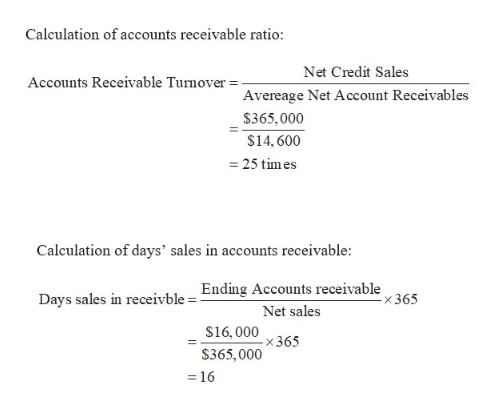

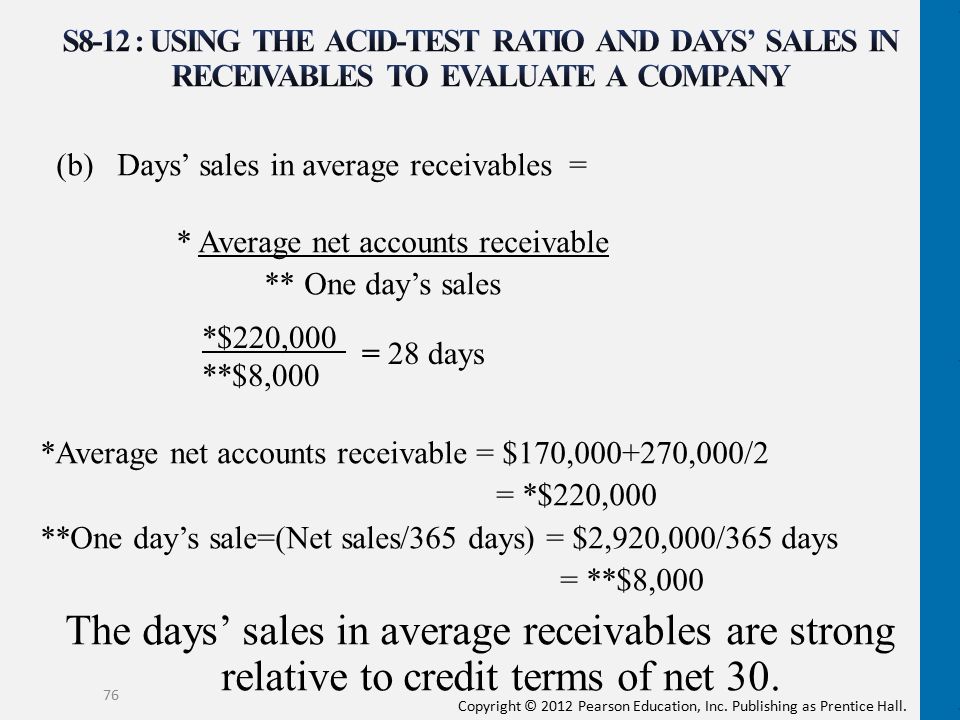

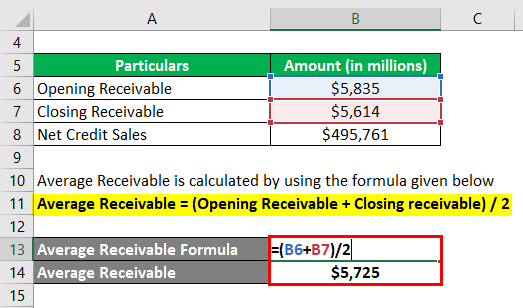

Receivable days formula is quite logical We take Average Receivables in the numerator and Credit Sales in the denominator and then we multiply by 365 Average Receivables is nothing but the simple average of receivable balanceAxel, Accofina's tutor, is spending less time developing this Channel From 21, his new focus will be startup BAS Services firm, Tracy & Associates AccounThe days' sales in accounts receivable can be calculated as follows the number of days in the year (use 360 or 365) divided by the accounts receivable turnover ratio during a past year For example, if a company's accounts receivable turnover ratio for the past year was 10, the days' sales in accounts receivable was 36 days (360 days divided by the turnover ratio of 10)

Days Sales Outstanding Dso Definition Calculation And Formula Zoho Books

Days Of Sales Outstanding Dso Definition Formula Example Industrial Average Calculator

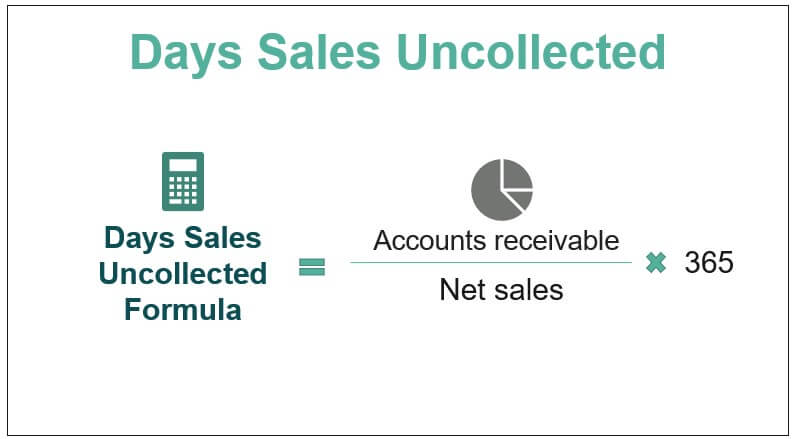

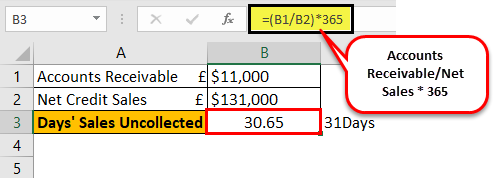

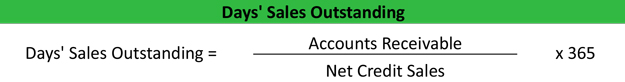

The days sales outstanding formula can be written as (accounts receivable / sales revenue) X number of days in measured period = DSO An effective way for businesses to use the DSO calculation is to keep it tracked month by month on a trend line or a series of plotted data points indicating a certain pattern or directionDays' Sales Uncollected Formula = Accounts Receivable/Net Sales * 365 =3065 days~ 31 days The company takes 31 days to collect cash So, it is a good ratio that Average accounts receivable = (,000 30,000) / 2 = 25,000 Days sales outstanding = Average accounts receivable / (Sales / 365) Days sales outstanding = 25,000 / (0,000 / 365) Days sales outstanding = 4563 days It takes the business on average 4563 days to collect accounts receivable from customers Days Sales Outstanding Example 2

Measure And Manage Collection Efficiency Using Dso Abc Amega

Http Www Gleim Com Public Accounting Updates Cpa Bec 19 Updates Sept 19 Pdf

Then, you can use the accounts receivable days formula to work out your total as follows Accounts Receivable Days = (1,000 / 800,000) x 365 = 5475 This tells us that Company A takes just under 55 days to collect a typical invoiceThe days sales outstanding formula is as follows Divide the total number of accounts receivable during a given period by the total value of credit sales during the same period and multiply theAverage accounts receivable is $10,000 a 78 b 75 c 468 d 487

A Better Way To Model Accounts Receivable And Accounts Payable By Dave Lishego Medium

O Days Sales In Average Receivables Or Days Sales Chegg Com

Formula Systems (1985) days sales in receivables from 06 to 21 Days sales in receivables can be defined as the average number of days it takes to collect outstanding receiveable amounts from customersDays sales in receivables gross receivables net sales / 365 accounts receivable turnover net sales average gross receivables accounts receivable turnover in days average gross receivables net sales / 365 days sales in receivables ending inventory cost of goods sold /This video introduces and includes an example of the financial statement analysis tool Days' Sales in Receivable Ratio@ProfAlldredge For best viewing, switc

Chapter 8 Receivables 15 1 What Are Common

F Xzppblgjkxnm

Average accounts receivable is $11,000 Year 1 Sales are $78,000;Interpretation Days Sales Outstanding shows how long it takes for a business to recover the revenue receipts from its trade receivables Using the example above, for instance, we can conclude that during the year ended 30 June X5 it took HIJ PLC an average of 15 days to collect revenue receipts from its trade debtors The accounts receivable turnover in days shows the average number of days that it takes a customer to pay the company for sales on credit The formula for the accounts receivable turnover in days is as follows Receivable turnover in days = 365 / Receivable turnover ratio Determining the accounts receivable turnover in days for Trinity Bikes Shop in the example

Match The Ratio With The Formula A Days Sales In Chegg Com

Days Sales Outstanding Examples With Excel Template Advantages

In order to compute the Days Sales in Receivables we first compute the Receivables turnover using the following formula The answer derivedThe beginning and ending accounts receivables are 000 and respectively DSO Accounts Receivables Net Credit Sales X Number of Days DSO Formula Accounts Receivables Net Credit Sales 365 Or Days Sales Outstanding 365 15 365 73 days 360 303 Accounts Receivable Turnover in year 1 was 285 daysNow, once we have the receivables turnover, we compute the Days' Sales in Receivables using \text {Days' Sales in Receivables} = \displaystyle \frac {365} {Receivables Turnover} Days' Sales in Receivables = ReceivablesT urnover365

What Is Days Sales Outstanding Dso Accountingcapital

Day Sales Outstanding Formula Calculator Scalefactor

Using the following endofyear information, calculate the number of days' sales in receivables for Year 2 Year 2 Sales are $,500;Days sales outstanding, also known as average collection period, measures the number of days it takes for a company to collect its accounts receivable from its clients The collection of receivables is commonly carried out by the billing department and this metric is a particularly important one to determine that department's efficiency On the otherRead More To calculate the ratio in days, in order to know the average number of days it takes a client to pay on a credit sale, the formula looks like this Accounts Receivable Turnover in Days = 365 / Accounts Receivables Turnover Ratio Or, in the Flo's Flower Shop example above, the calculation would look like this

O Days Sales In Average Receivables Or Days Sales Chegg Com

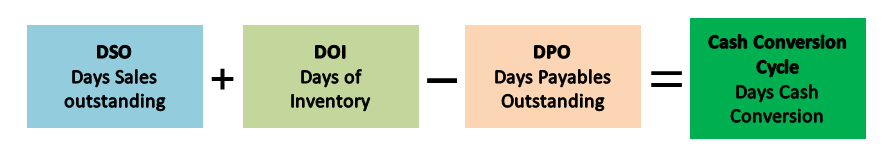

Cash Conversion Cycle Overview Example Cash Conversion Cycle Formula

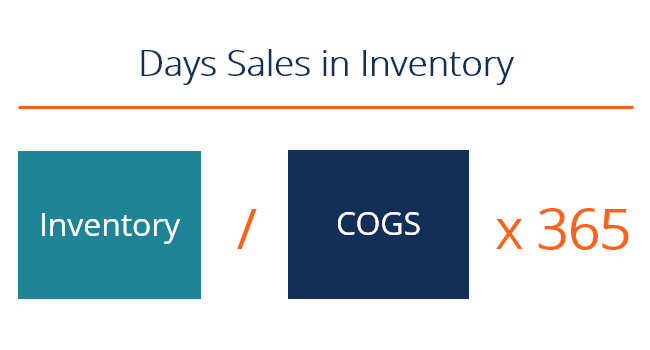

Formula for Days Sales Outstanding To calculate DSO, you should divide the accounts receivable of a period by the total net credit sales, and then multiply the result by the total number of days in the period The formula for calculating DSO is as follows DSO = Accounts Receivables / Net Credit Sales X Number of Days Divide the credit sales by 365 In the example, $1 million divided by 365 equals $2, per day These are the credit sales per day Divide the ending accounts receivable by the credit sales per day to find the average days in receivables In the example, $500,000 divided by $2, per day equals 15 days ReferencesDSI is calculated based on the average value of the inventory and cost of goods sold during a given period or as of a particular date Mathematically, the number of days in

Dso Calculation

Days Sales Outstanding Dso Knowledge Center And Forum 12manage

Conversely, a days sales outstanding figure that is very close to the payment terms granted probably indicates that a company's credit policy is too tight The formula for days sales outstanding is (Accounts receivable ÷ Annual revenue) × Number of days in the year Example of Days Sales Outstanding

Receivable Turnover Ratio Formula Calculate Interpretation Benchmark

Financial Statement Analysis Ppt Download

Days Sales Uncollected Different Examples With Limitations

Day S Sales Uncollected Formula Step By Step Calculation Examples

Days Sales Outstanding Formula Meaning Example And Interpretation

Answered Calculate Activity Measures The Bartleby

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

Days Sales Outstanding Formula Meaning Example And Interpretation

Nobles Fin5 Ppt 15

Accounts Receivable Turnover Ratio Formula Examples

Days Sales Outstanding Formula Meaning Example And Interpretation

Days Sales Outstanding Dso Ratio Formula Calculation

Debtor Days Formula Calculator Excel Template

Days Of Sales Outstanding Everything You Need To Know

Days Sales Outstanding Dso Youtube

Days Sales Outstanding Examples With Excel Template Advantages

Days Sales Outstanding Dso Definition

9 Tips To Improve Your Accounts Receivable Turnover Enkel

Days Sales Outstanding Dso Ratio Formula Calculation

Days Sales Outstanding Calculator Plan Projections

Dso How To Calculate Days Sales Outstanding Why It Matters

Based On The Following Data For The Current Year Chegg Com

Solved Select The Formula And Calculate Marshall S Days Sales 1 Answer Transtutors

A Look At The Cash Conversion Cycle

What Is The Receivables Turnover Ratio Fourweekmba

What Is Days Sales Outstanding Dso Accountingcapital

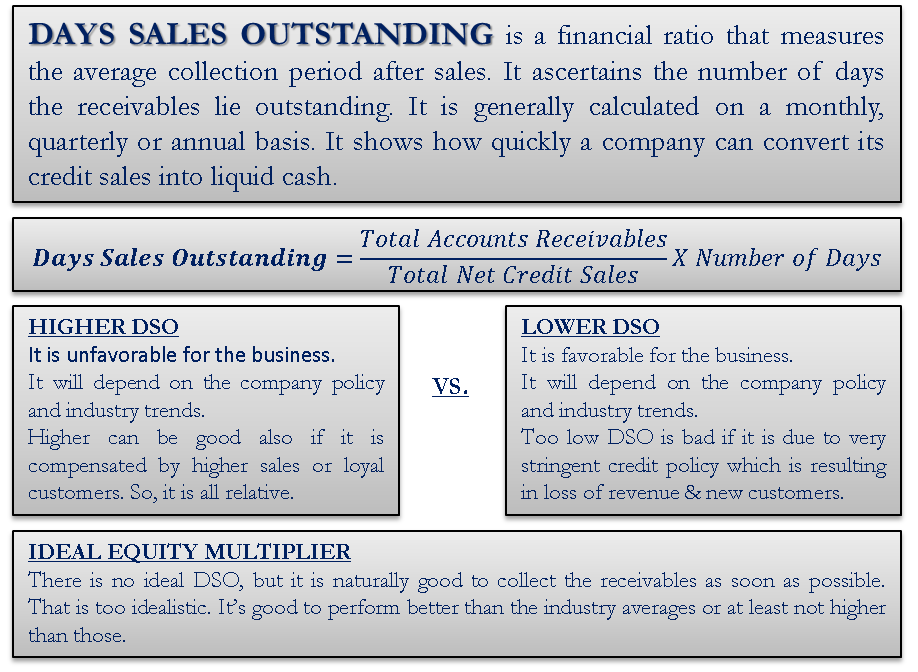

Week 5 Learning Journal Studocu

Days Sales Outstanding Define Formula Calculate Analysis Ideal Dso

Days Sales Outstanding Double Entry Bookkeeping

Days Sales In Inventory Dsi Overview How To Calculate Importance

Days Sales In Receivables Example Youtube

Accounts Receivable Formula Importance Impact

Accounts Receivable Turnover Ratio Bestbussinesscircle

Q Tbn And9gcrc09u0jqh9tklpssdcp0zakjbjyvrtfu3nhuc5k9ddrcu9f 5g Usqp Cau

4 Ways To Reduce Your Company S Days Sales Outstanding Dso Receeve Gmbh

O Days Sales In Average Receivables Or Days Sales Chegg Com

Objective 5 Calculate The Acid Test Ratio And Days Sales In Receivables Ppt Download

How To Calculate Dso On Accounts Receivables Billtrust

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

I Do Not Understand How The Accounts Receivable Chegg Com

Accounts Receivable Turnover Days

The Trouble With Dso Cfo

How To Calculate Days Sales Outstanding Or Dso Calculation Paysimple

How To Improve Debtor S Receivable Turnover Ratio Collection Period

Finance Ratio The Dso Calculation With Average Dso For The S P 500

What Is The Receivables Turnover Ratio Fourweekmba

A Step By Step Guide To Calculating Days Sales Outstanding The Blueprint

Day S Sales Uncollected Formula Step By Step Calculation Examples

Days Sales Outstanding Kpi Sense

Efficiency Ratio Days Sales In Receivables Or Days Sales Outstanding Youtube

Measure And Manage Collection Efficiency Using Dso Abc Amega

Days Sales Outstanding Template Download Free Excel Template

How To Calculate Days Sales Outstanding Dso Finance Friend

Receivables Chapter 8 Chapter 8 Explains Receivables Ppt Download

9 Tips To Improve Your Accounts Receivable Turnover Enkel

Nobles Fin5 Ppt 15

Why Dso Should Be A Focus Kpi For Your Company Intellichief

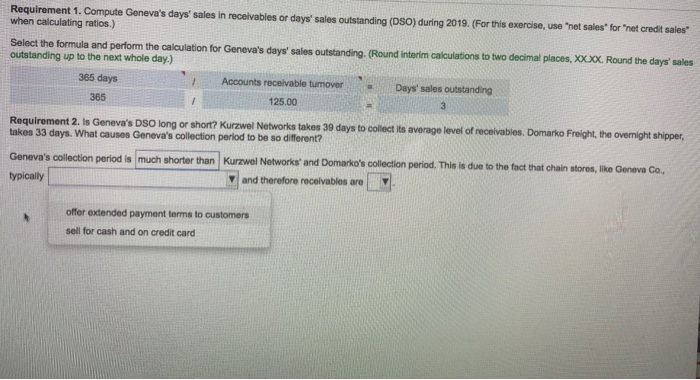

Requirement 1 Compute Geneva S Days Sales In Chegg Com

What Is The Accounts Receivable Days Formula Gocardless

What Is Dso And How Do I Calculate It Measuring Days Sales Outstanding A How To Guide Invoicecare

Everything You Need To Know About Days Sales Outstanding

How To Improve Your Dso

1

Average Collection Period Formula Examples Calculation Newyork City Voices

Accounts Receivable To Sales Ratio How To Calculate The Ratio

1

Measuring Days Sales Outstanding Dso Calculator

Financial Statement Analysis Chapter 9 Ppt Download

Days Sales Outstanding Meaning Formula Calculate Dso

/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)

Calculating The Cash Conversion Cycle Ccc

Days Sales Outstanding Formula Meaning Example And Interpretation

Debtor Days Meaning Formula Calculate Debtor Days Ratio

Days Sales Outstanding Calculation For A Specific Period Sap Documentation

Computing Days Sales In Receivables Youtube

Days Sales Uncollected Different Examples With Limitations

Accounts Receivable Turnover Ratio Bestbussinesscircle

Determine The Efficiency Of Receivables Management Using Financial Ratios Principles Of Accounting Volume 1 Financial Accounting

Days Sales Outstanding Examples With Excel Template Advantages

Accounts Receivable Turnover Ratio Formula Examples

Days Sales Outstanding Average Collection Period Youtube

Accounts Receivable Turnover Ratio Formula Examples

Finance Ratio The Dso Calculation With Average Dso For The S P 500

Days Sales Outstanding Dso Definition Formula Importance

0 件のコメント:

コメントを投稿